To give credibility to the expectation that your energy project delivers not only comfort and performance but profits, you need accurate estimates of its financial worth.

Financial analyses

Before making an investment into energy systems consider the potential monetary gains/losses. Is it worth it? Our finance professionals carry out full financial analysis of energy projects, forecasting the period, revenue growth, and free cash flows of the investment, as well as calculating the discount rate.

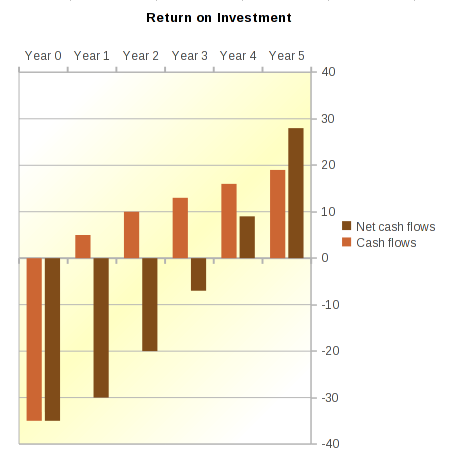

Our finance professionals supply you with complete reports and informative graph charts, such as the one shown below. With this information, you can approach investors and apply for financing.

On the graph above, the initial investment in year 0 marks the start of your project. Positive cash flows in the following years reflect increased gains or reduced costs as a result of the implementiation of the projects. The probabilities of different ROI outcomes give you/your investor an overview of the net effect of the investment.

Business plan preparation

A business plan is required for applying for financing from banks and/or private investment (private equity) funds, wealthy individuals, etc. A professionally developed business plan is evidence that you have a vision for managing your business, including how to lead, make decisions, market, manage employees, and forecast, use technology and finance growth.

We prepare formal business plans with professional content, layout and style, ready to be delivered to investors/lenders or government agencies. Your business plan will includes:

- executive summary

- introduction to your business or proposed business idea (the product/service)

- detailed description of your business idea

- management team (the people behind your business idea)

- strenths, weaknesses, opportunities and threats (SWOT) analysis

- financial analysis and budget

- structure of the wanted financing

- marketing and sales strategy

- use of technology

- exit strategy for the investor.